XBRL from the bottom up

With this blog post I will try to explain XBRL as simple as possible using a problem-solving oriented approach. I will show the challenges in transferring financial data and explain how XBRL solves them. For a more detailed and traditional explanation, please check out this blog post: What is XBRL?.

Ok, so our goal is to transfer some financial data. Let’s say we want to tell the world that we generated 15.7 million USD in Revenue in 2020. We also want our revenue report to be machine readable, no old-school pdf’s! How can we encode and transfer our financial data?

The common approach would be to create another markup language, perhaps YAML 2.0 😉. On the other hand, it might also be smart to simply use an already existing and established standard. How about the most famous markup language in the world - XML?

In XML, we could encode our data as follows:

<?xml version="1.0" encoding="utf-8"?>

<report>

<revenue unit="usd" from="01.01.2020" to="31.12.2020">15700000</revenue>

</report>

Great, our data point ($15.7M Revenue in 2020) is now machine-readable and encoded in a widely established standard. Now we can send out our report and tell the world how much profit we made, right?

Not so fast. There are a couple of issues with our report:

- The recipient of the xml file does not know which company to congratulate for the $15.7M in revenues.

- In an annual report, we will have hundreds of financial data points from the same period. We would have to redefine the period and the company (to which the number belongs) for every data point.

- The unit of this example is quite simple. But how do we deal with financial data like “earnings per share” which would have the unit “USD per share”?

Ok, let’s make some improvements to our xml report:

<?xml version="1.0" encoding="utf-8"?>

<report>

<unit id="usd">

<measure>USD</measure>

</unit>

<context id="2020FY">

<startDate>01.01.2020</startDate>

<endDate>31.12.2020</endDate>

<entity>865985</entity> <!-- This is our company identifier that the auditors gave us-->

</context>

<revenue unit="usd" context="2020FY">16000000</revenue>

</report>

We have now solved the problems from above relatively well, can we send the report now? Unfortunately not quite…

We are obviously not the only company in the world. If everyone did what we do, the persons receiving the reports would have a really bad time processing hundreds of slightly different reports. We need a way to define the general structure of the report so that all financial reports have the same structure. Fortunately, XML provides an excellent way to specify the structure of an XML file with XML schemas.

This is where the XML Specification comes into play. Fortunately, some clever minds have already created it, so we will just use it here for now and not go into the schema file itself.

<?xml version="1.0" encoding="utf-8" ?>

<xbrli:xbrl

xmlns:xbrli="http://www.xbrl.org/2003/instance"

xmlns:iso4217="http://www.xbrl.org/2003/iso4217">

<xbrli:unit id="usd">

<xbrli:measure>iso4217:USD</xbrli:measure>

</xbrli:unit>

<xbrli:context id="2020FY">

<xbrli:entity>

<xbrli:identifier scheme="http://www.sec.gov/CIK">0000320193</xbrli:identifier>

</xbrli:entity>

<xbrli:period>

<xbrli:startDate>2016-09-25</xbrli:startDate>

<xbrli:endDate>2017-09-30</xbrli:endDate>

</xbrli:period>

</xbrli:context>

<revenue unitRef="usd" contextRef="2020FY">16000000</revenue>

</xbrli:xbrl>

By using the xbrli namespace we show that we are using the XML elements (<unit>, <context>, <period>, <identifier> etc.) of the XBRL specification. An XML validator could now check for each element whether it has the correct children and all necessary attributes. For example, for the <identifier> element, the XBRL specification requires that it has an attribute scheme that indicates which type of company identification number the element contains.

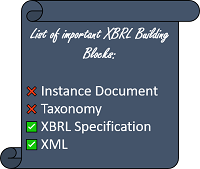

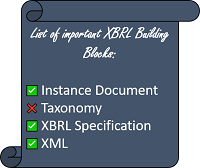

By the way, the XML file we are creating is called Instance Document in the XBRL jargon. It holds all our financials that we want to publish. - So, we can check another box 🥳.

To summarize; the basic structure of our Instance Document (our XML report) is now defined by the XBRL Specification. We have introduced contexts that contain information about the timeframe and company a number is related to. We have also introduced unit-elements that define the unit that belongs to our number. Both units and contexts can be referenced many times in our Instance Document.

But one thing is missing. Currently no one tells us which financial information we can encode in our document. Currently we only have one <revenue> element. Can we add another called <cash>? This is regulated by a so-called Taxonomy. The taxonomy defines the different (accounting) concepts that can be used in the Instance Document. It also contains additional information about the relationships between multiple concepts and additional resources for concepts (e.g. labels), but I won’t go into that in this blog post.

Our Instance Document:

<?xml version="1.0" encoding="utf-8" ?>

<xbrli:xbrl

xmlns:xbrli="http://www.xbrl.org/2003/instance"

xmlns:iso4217="http://www.xbrl.org/2003/iso4217"

xmlns:us-gaap="http://fasb.org/us-gaap/2020-01-31">

<xbrli:unit id="usd">

<xbrli:measure>iso4217:USD</xbrli:measure>

</xbrli:unit>

<xbrli:context id="2020FY">

<xbrli:entity>

<xbrli:identifier scheme="http://www.sec.gov/CIK">0000320193</xbrli:identifier>

</xbrli:entity>

<xbrli:period>

<xbrli:startDate>2016-09-25</xbrli:startDate>

<xbrli:endDate>2017-09-30</xbrli:endDate>

</xbrli:period>

</xbrli:context>

<!-- This is new, we are now using the us-gaap prefix -->

<us-gaap:Revenue unitRef="usd" contextRef="2020FY">16000000</us-gaap:Revenue>

</xbrli:xbrl>

The Taxonomy:

<xsd:schema

xmlns:xsd="http://www.w3.org/2001/XMLSchema"

xmlns:xbrli="http://www.xbrl.org/2003/instance">

<xsd:element id="us-gaap-Revenue" name="Revenue"

nillable="true" substitutionGroup="xbrli:item"

type="xbrli:monetaryItemType"

xbrli:balance="credit" xbrli:periodType="duration"/>

<!-- Many more xml elements (Concepts)... -->

</xsd:schema>

Actually, this is just the Taxonomy schema. In the real world, a taxonomy would be much more complex!

Our Instance Document now uses the tag <us-gaap:Revenue> for the fact. The namespace http://fasb.org/us-gaap/2020-01-31 shows us that we are referring to the concept Revenue from the us-gaap taxonomy of 2020. The Taxonomy also stores additional information about the concept Revenue. This information also allows the receiver of our report to validate it.

Summary

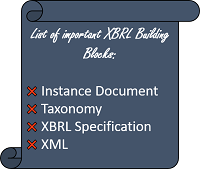

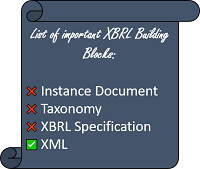

To summarize: Our goal is to transfer financial data. Each financial data point is called a Fact. To each fact belongs a Context that stores information about the date or timeframe as well as the company the fact belongs to. Most facts also have a Unit attached to them. To transfer our facts, we start by creating an XML document. This XML document is called Instance Document. The structure of our Instance Document is defined by the XBRL Specification. The different concepts we can use for tagging our facts i.e.: (Assets, Liabilities, CashAndCashEquivalentsAtCarryingValue) are defined in the Taxonomy.

This blog post is written with the goal of providing the most easily digestible technical introduction to XBRL. However, it is therefore somewhat imprecise in some places and/or omits important elements. A more detailed description can be found in my Blog Post What is XBRL?.